SoftSettle Support

Absolutely, it won’t be easy.

If you are facing a mountain of debts say the mountain like Uhood in Mecca, Saudi Arabia, it is time to buckle down and get serious about getting it cleared even if it seem like an impossible task. But there is just no way around it.

Debt repayment is painful. By the time you are paying off a loan, you might have utilized that money – might have reaped rewards or might have gone into deep trouble. If you could not make the return out of the borrowed money, you may feel that the payment you make is twice as painful and getting nothing out of it.

No wonder we are so hesitant to pay our debts. Every month we are reminded that we owe money and every month we grit our teeth and push that debt to the back of our minds until the next month when the cycle occurs all over again.

The peace of mind would alone be worth it. Without that monthly nagging in the back of your mind, you would be able to sleep easier at night. Every unloaded debt is one less bill to worry about. The Creditor gets agonized and he use every available tool to snatch the money from you at any cost. This would make you mad. Probably you may get inspired to be offensive against them. But they could not be desisted till you offer something constructively in record.

But most of all, it’s the greater financial freedom that most of us want. Think of all the dreams you had to put on hold because of the money you owe. If you didn’t have debt dragging you down, what would you be spending that money on? Which dreams would you finally be able to pursue? At this point, it’s not just about reducing stress or increasing financial security. It’s about being able to live your life to the fullest every day.

Reduce the debt; to go till debts gets cleared

It is lot easier that done, of course. Every reduction in debt balance has to be paid by someone. You can see why creditors are not exactly enthusiastic about renegotiating debt amounts.

But it is possible.

Down here, it is appropriate to talk about reducing the minimum monthly payment. May be it is a good idea if you are struggling to meet your minimum monthly payment as it stands. But the irony is that by reducing the minimum monthly payment you are likely going to owe more money in the long run. Instead we have to find out some viable alternatives.

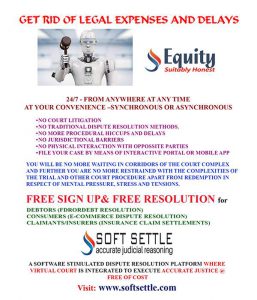

The first thing you should do is to sign up freely in www.softsettle.com if you find web portal acceptable or sign up freely in the mob.app under the name and tittle of SoftSettle Support. You may be facilitated to contact your creditor/lender and offer them your intentions to make the payment properly or settle the entire payment with some conditions and you will be duly in receipt of the counter offer from the creditor/lender with a desisting letter ceasing all harassment from the part of their collection/recovery agents. The creditor will help you explore the options and let you renegotiate and improve the terms of loans. Again, lenders aren’t too excited about directly reducing the debt balance, but they’re usually open to waiving fees and charges that you may have accumulated. Explain your situation, convince them that you’re serious about paying off what you owe, and see if they’re open to reducing your interest rate and/or principal balance. With all these counter offers, the creditor is ready to participate in the e-resolution process endorsed by www.softsettle.com which you need not pay any fees and you are entitled to participate freely in the resolution process, where the negotiating parties can reach a settlement with the EMI reshuffled and repayment plan rescheduled. The matter of reshuffling and rescheduling to a great extent depends upon your dealing of fund availability. An Agreement gets automatically generated to this effect and both parties can sign it offline or digitally so that a new agreement will come into effect.

You are in full control of the process and once the result of the resolution comes in your favor, you are free from the clutches of debt and your opportunity to clear off the debts without further apprehensions and more excited about settling the debts as per the agreement .

Hence the SoftSettle Support or www.softsettle.com would be the future hope of everybody who wants to settle the debts as fast as possible.